Table of Contents

Have you already filed your return? So let us tell you how to check income tax return status online, explain the methods available, what each status means, and offer expert tips to avoid common mistakes. Let’s read on to know more about it.

1. What is an Income Tax Refund?

- Income tax refund is the amount that is returned to the taxpayer when the total tax paid exceeds the actual tax liability for a financial year.

- This situation often arises when excess tax has been deducted at source (TDS) or the taxpayer has paid more advance tax or self-assessment tax than the amount he actually owes.

- For example, salaried individuals often find themselves eligible for refunds if they deduct higher TDS on their employees without accounting for investment declarations.

- Similarly, business owners and freelancers who pay advance tax based on estimated income may also end up paying more due to fluctuating income.

- In such cases, the Income Tax Department processes the refund after verifying the filed income tax return (ITR).

2. How to check refund has been processed

- But how can you know if your refund has been processed or credited to your account? This is where it becomes important to understand how to check income tax

- return status online. By tracking your refund status online, you can stay updated and take immediate action in case of any errors or delays.

- If you contact a leading CA firm in Kanpur, we will help you in monitoring your ITR filed, we often tell our clients about the importance of monitoring the status of their ITR after filing.

- Many people believe that once the return is filed, the job is done, but that is not the case. Without checking the status, you may miss out on important updates like refund rejections, bank account discrepancies, or processing errors.

3. Prerequisites to Check Refund Status Online

There are a few important things to know before you begin the refund checking process. Checking income tax return status online is one thing, but having the right information ready will make the process seamless and hassle-free.

| 1. PAN (Permanent Account Number) | Your PAN is your unique identification in the Income Tax system. You must enter your correct PAN to get any information related to your income tax return or refund status. Make sure there are no errors while entering it on the portal. |

| 2. ITR Acknowledgement Number | When you file your ITR, you receive an acknowledgement number (usually a 15-digit number). This number is useful for tracking refunds, especially on the NSDL portal. If you are using the e-filing portal, PAN and assessment year are often sufficient, but it is still recommended to keep the acknowledgement handy. |

| 3. Assessment Year | The refund status is shown as per a specific assessment year. For example, if you filed your return for the financial year 2023-24, the relevant assessment year would be 2024-25. Selecting the correct year ensures that you get accurate results when you check your status. |

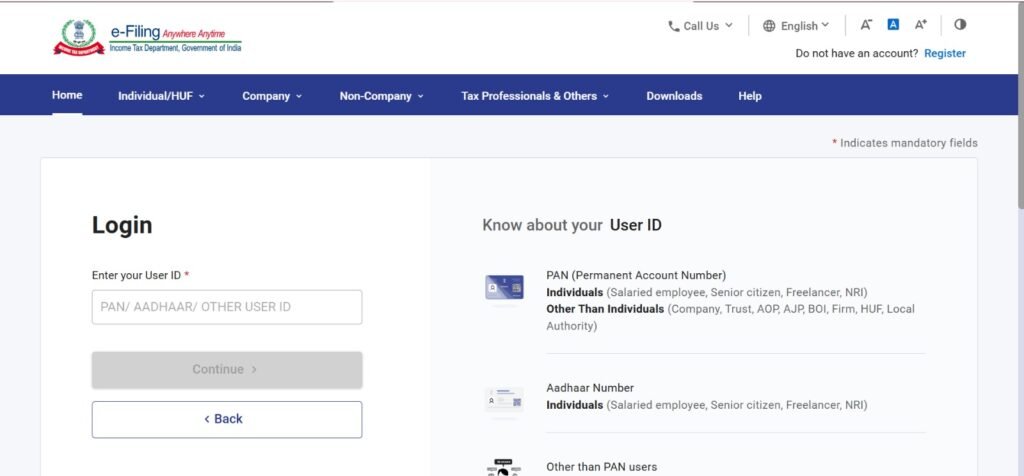

| 4. E-Filing Portal Login Credentials | If you’re checking through the Income Tax e-filing portal, you must log in using your User ID (PAN) and password. Make sure your login credentials are active and updated. |

| 5. Pre-Validated Bank Account | To receive the refund directly in your bank account, it must be pre-validated and linked with your PAN. If your bank account isn’t validated, your refund may fail or get delayed. |

| 6. Registered Mobile Number or Email ID | You may receive OTPs (One Time Passwords) or status notifications on your registered contact details. Make sure your mobile number and email are active and linked to your income tax profile. |

4. Methods how to check online income tax return status

The Income Tax e-Filing portal is the official government platform where you can file returns, respond to notices, and check your refund status.

Follow these steps:

1. Firstly visit the official Income Tax e-filing website: https://www.incometax.gov.in/ Then log in using your PAN (as user ID) and your account password.

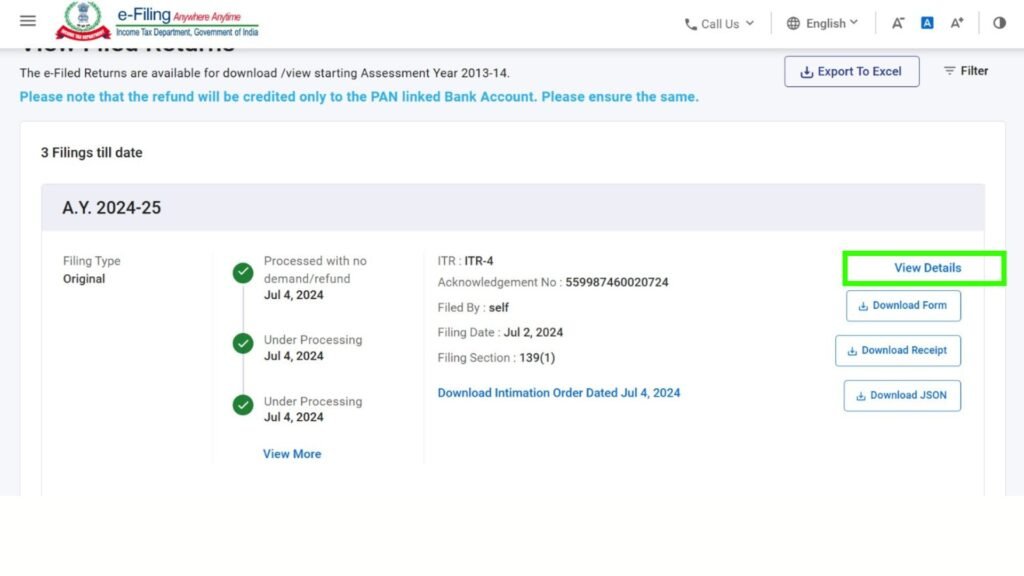

2. Then go to “e-File” tab and click on Income Tax Returns > View Filed Returns

3. Select the relevant Assessment Year (e.g., 2024–25 for FY 2023–24).and You can see the status of your current and past income tax returns.

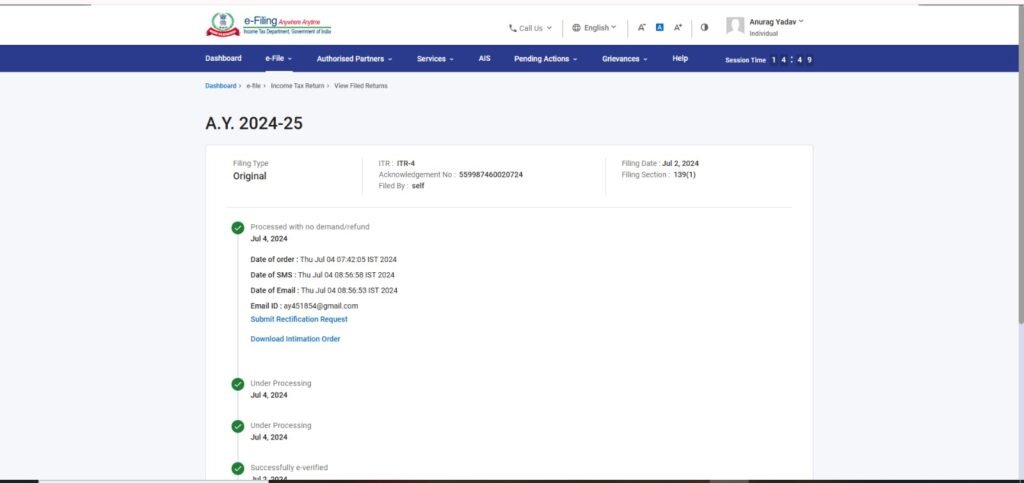

4. Click on “View Details”, and you’ll see the status of your income tax refund, as shown in the picture below.

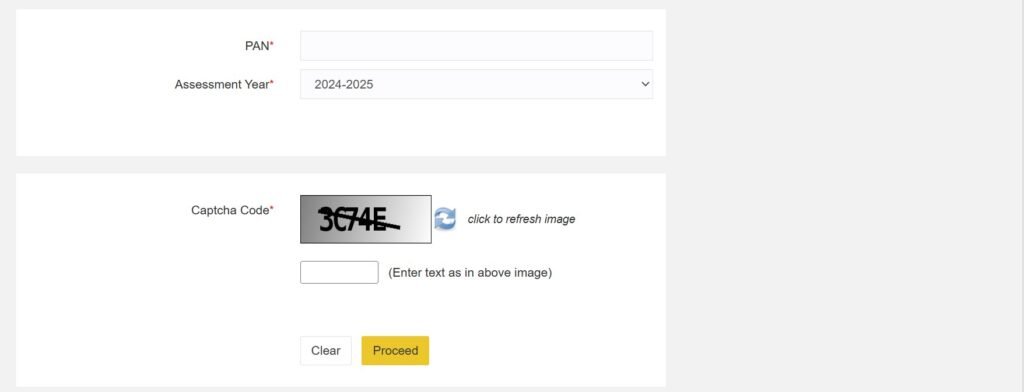

Step 1. Go to the NSDL portal

Step 2. Enter your PAN number. Choose the Assessment Year Enter the captcha code and click “Submit”

Step 3. Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

5. Refund Status Messages and Their Meanings

Once you learn how to check income tax return status online, the next important step is to understand what the refund status messages actually mean. These messages are generated by the Income Tax Department or the NSDL portal based on the current status of your refund request.

At Smart Tax Saver, a trusted CA firm in Kanpur, we often guide clients who get confused by these technical messages. So, let’s understand them in simple terms.

| 1. Refund Issued | This is the message every taxpayer loves to see! It means your refund has been successfully processed and credited to your validated bank account. You should check your bank statement for the credit entry. |

| 2. Refund Failed | This status indicates that your refund could not be deposited into your bank account. Common reasons include: . Incorrect bank account number . Account not pre-validated . Bank account closed Solution: Log in to the e-filing portal, update and revalidate your bank details, and request re-issuance of the refund. |

| 3. No Demand, No Refund | This means that as per the Income Tax Department’s count, no excess tax has been paid, and hence no refund is due. Your return has been processed successfully, but your count may not match the department’s count. |

| 4. Refund Adjusted Against Outstanding Demand | If you have any pending tax dues from previous years, your current year refund can be adjusted against it. You will be informed under section 245 before this adjustment is made. |

| 5. Refund Returned | This message will appear if the refund was issued via cheque or ECS and was not delivered or returned. This is usually due to address issues (for cheques) or account closure (for ECS). |

| 6. Return Processed – Refund Determined and Sent to Refund Banker | This status means that the Income Tax Department has completed processing your ITR and the refund has been sent to the bank for payment. You will receive the refund soon, usually within a few working days. |

| 7. Return Submitted and Pending for Processing | If you see this status, your return has been filed successfully but has not been processed by the department yet. Refund will be initiated only after the processing is completed. |

8. ITR Processed – No Refund Due | Your ITR has been processed, but as per the department’s records, you are not due any refund. This could be due to incorrect calculations, incorrect entry of deductions, or mismatch in income reporting. |

6. What is the time period for tax refund? Let’s know

The time taken to receive an income tax refund depends entirely on the internal process of the Income Tax Department. Generally, it takes around 7 to 120 days, with an average of 90 days after you e-verify your return. The Income Tax Department has implemented a new refund processing system to enable faster refund processing with an expected turnaround of a few days instead of a few months.

7. Is Interest on Income Tax Refund Taxable?

Interest on income tax refund is paid by the Income Tax Department to you as the refund is delayed, which is calculated at the rate of 0.5% per month (6% per annum) under section 244A. This is applicable when excess tax is paid through TDS, TCS, advance tax or self-assessment tax, and the refund is more than ₹100.

Pingback: ITR Filing Service In Kanpur | Online Trusted Tax Filing Assistance