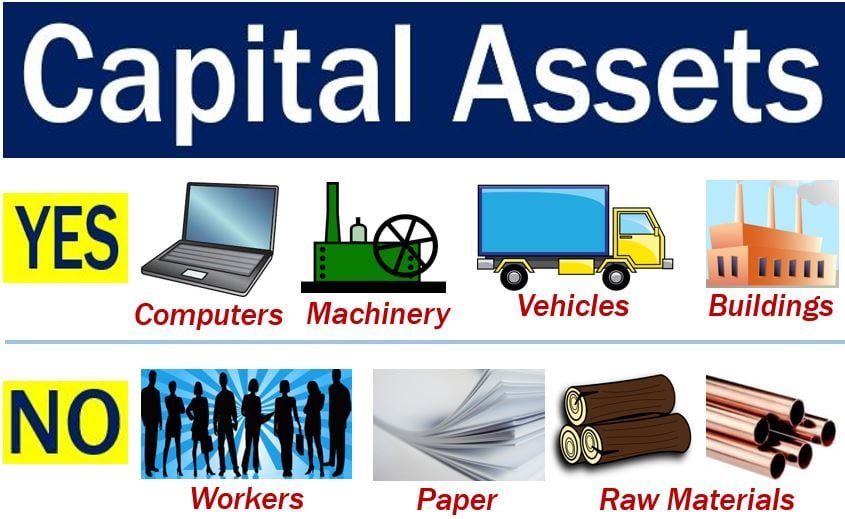

When dealing with capital assets, understanding the cost of acquisition is crucial for accurately calculating capital gains tax. Section 49 of the Income Tax Act, 1961, provides detailed guidelines on how to determine the cost of acquisition in various scenarios, particularly when assets are acquired through specific modes outlined under Section 47. In this comprehensive guide, we’ll explore the key provisions of Section 49, helping you navigate the complexities of capital gains computation.

What is Section 49 of the Income Tax Act?

Section 49 of the Income Tax Act, 1961, deals with the determination of the cost of acquisition of a capital asset when it is acquired through certain specific modes. This section becomes particularly relevant when the capital asset is acquired under circumstances where the actual cost may not be straightforward, such as during corporate restructurings, amalgamations, demergers, or when dealing with financial instruments like shares, debentures, or Global Depository Receipts (GDRs).

Key Provisions of Section 49

Let’s break down the critical sub-sections under Section 49 and understand their implications:

- Cost of Acquisition for Shares or Debentures (Sub-sections 2A to 2ABB)

- Sub-section (2A): When the capital asset is a share or debenture acquired through specific transfers under Section 47 (such as transfers between parent and subsidiary companies or during an amalgamation), the cost of acquisition is deemed to be the proportionate cost of the original debenture, debenture stock, bond, or deposit certificate. This ensures that the cost basis is accurately reflected in the capital gains calculation.

- Sub-section (2AA): If the capital gain arises from the transfer of specified securities or sweat equity shares, as mentioned in Section 17(2)(vi), the cost of acquisition is considered the fair market value (FMV) that was used for tax purposes at the time of the grant. This FMV is crucial for determining the accurate taxable gain or loss upon transfer.

- Sub-section (2AAA): In scenarios where the capital asset consists of partnership rights in a Limited Liability Partnership (LLP), acquired due to conversion under Section 47(xiiib), the cost of acquisition is deemed to be the cost of the shares in the company before conversion. This provision ensures continuity in the cost basis from the company to the LLP.

- Sub-section (2AB): Similar to Sub-section (2AA), this provision applies when specified securities or sweat equity shares are transferred, but with the focus on the fringe benefits valuation under Section 115WC(1)(ba). The cost of acquisition here is the FMV considered for computing the value of fringe benefits.

- Sub-section (2ABB): For non-resident assessees who acquire shares through the redemption of Global Depository Receipts (GDRs) under Section 115AC(1)(b), the cost of acquisition is the stock exchange price of the shares on the date the redemption request is made. This provision ensures that the acquisition cost reflects the market conditions at the time of redemption.

- Cost of Acquisition in Amalgamation or Demerger (Sub-sections 2C to 2D)

- Sub-section (2C): In the event of a demerger, the cost of acquisition of shares in the resulting company is calculated based on the proportionate net book value of assets transferred compared to the net worth of the demerged company. This proportionate calculation helps in maintaining the continuity of the cost basis between the demerged and resulting companies.

- Sub-section (2D): Following the principles of Sub-section (2C), the cost of acquisition of the original shares in the demerged company is adjusted downward by the proportionate amount. This adjustment ensures that the cost basis reflects the demerger’s impact on the original company’s value.

- Explanation: For clarity, “net worth” in this context is defined as the aggregate of paid-up share capital and general reserves as recorded in the demerged company’s books before the demerger. This definition is critical for ensuring consistency in calculating the cost basis during corporate restructuring.

- Special Cases

- Sub-section (2E): The provisions of Sub-sections (2), (2C), and (2D) are extended to apply to business reorganizations of co-operative banks as per Section 44DB. This ensures that similar principles for cost allocation are used across different types of entities undergoing restructuring.

- Sub-sections (2AF) & (2AG): These sub-sections provide specific rules for cases involving the consolidation or segregation of mutual fund units and related portfolios. For instance, when a unit holder acquires units in a consolidated scheme or segregated portfolio, the cost of acquisition is determined based on the proportionate value of the assets before and after the consolidation or segregation.

- Sub-section (2AH): This provision further elaborates that the cost of the original units in the main portfolio shall be reduced by the amount allocated to the segregated portfolio. This ensures that the total cost remains consistent across the portfolio before and after the segregation.

Practical Implications for Taxpayers

Understanding the provisions of Section 49 is vital for taxpayers involved in complex transactions, especially those involving corporate restructuring, share transfers, or financial instruments. Accurate calculation of the cost of acquisition ensures that the capital gains tax is computed correctly, thereby avoiding potential disputes with tax authorities.

For example, when acquiring shares through an amalgamation, taxpayers must carefully consider the proportionate cost basis as outlined in Sub-sections (2C) and (2D). Similarly, non-resident investors redeeming GDRs should be aware of the stock exchange price on the redemption date, as specified in Sub-section (2ABB).

FAQs on Section 49 of the Income Tax Act

Q1: What is the significance of Section 49 in the Income Tax Act? Section 49 provides guidelines for determining the cost of acquisition of capital assets acquired through specific modes. This is crucial for accurate capital gains tax calculation.

Q2: How does Section 49 impact capital gains tax computation? Section 49 affects the capital gains tax computation by determining the correct cost of acquisition for assets acquired through specific transfers, ensuring that the taxable gain or loss is accurately reflected.

Q3: Can Section 49 provisions be applied to all types of assets? No, Section 49 mainly applies to certain capital assets such as shares, debentures, specified securities, and units in mutual funds, especially when acquired through specific transfers under Section 47.

Q4: What is the importance of the fair market value (FMV) in Section 49? The FMV is crucial in determining the cost of acquisition for specified securities or sweat equity shares, particularly when these assets are subject to tax under Section 17(2)(vi) or fringe benefits tax under Section 115WC.

Conclusion

Section 49 of the Income Tax Act plays a pivotal role in determining the cost of acquisition for capital assets acquired through various specific modes. By understanding and applying these provisions correctly, taxpayers can ensure that their capital gains tax computations are accurate, thereby avoiding potential tax liabilities and disputes. Whether you’re dealing with amalgamations, demergers, or financial instruments, a clear grasp of Section 49 is essential for sound tax planning and compliance.

For more detailed insights into tax laws and to explore how they impact your financial planning, visit SmartTaxSaver.com, where we offer expert advice and resources tailored to your needs.